Top 8 best Payroll tools for Small Businesses in 2024

Small business management, staying on top of payroll can feel like juggling flaming torches. With countless details to handle and ever-changing regulations, finding the right payroll tool is crucial. Imagine a tool that not only simplifies payroll but also boosts your business’s efficiency and compliance. Sounds like a dream, right? Well, it’s not far off!

In 2024, Payroll tools is more advanced than ever, offering small businesses powerful solutions to streamline their payroll processes. From automating tax filings to integrating with your existing software, the right payroll tool can save you time and reduce stress.

In this guide, we’ll explore the top 8 payroll tools for small businesses, each one designed to handle the complexities of payroll with ease. So, let’s dive in and discover how these tools can transform your payroll process!

Standout features:

Gusto excels with its all-in-one approach, combining payroll processing with HR management in a user-friendly platform.

How Payroll Tools Work & Why Small Businesses Need Them

Managing payroll might seem straightforward—simply pay your employees and handle some paperwork. But as any small business owner knows, the reality is much more complex.

Payroll involves calculating wages, withholding taxes, managing benefits, and complying with various regulations. This complexity can lead to errors, missed deadlines, and compliance issues. That’s where payroll tools come in.

How Payroll Tools Work

Payroll tools are designed to automate and simplify the entire payroll process.

- Data Collection: Payroll tools gather all necessary employee information, including hours worked, salary details, and deductions. This data can be input manually or synced from time-tracking systems.

- Calculation: They automatically calculate gross pay, withhold taxes, and apply deductions for benefits, retirement contributions, and other variables. This ensures accuracy and saves time compared to manual calculations.

- Tax Filing and Compliance: Many payroll tools handle tax calculations and filings, keeping you up-to-date with federal and state regulations. They also generate and file necessary tax forms, reducing the risk of compliance issues.

- Direct Deposit: Payroll tools often support direct deposit, allowing employees to receive their paychecks directly into their bank accounts. This feature simplifies the payment process and ensures timely payments.

- Reporting: These tools generate reports on payroll expenses, tax withholdings, and other financial metrics. These reports are valuable for budgeting and financial planning.

Why Small Businesses Need Payroll Tools

For small businesses, managing payroll efficiently can be a game-changer.

- Time Savings: Manual payroll processing is time-consuming. Payroll tools automate repetitive tasks, freeing up your time to focus on growing your business.

- Accuracy: Automated calculations minimize the risk of errors in payroll. Accurate paychecks and tax filings are crucial to avoid penalties and maintain employee trust.

- Compliance: Keeping up with changing tax laws and regulations is challenging. Payroll tools ensure that your business remains compliant with all necessary regulations, reducing the risk of costly fines.

- Employee Satisfaction: Timely and accurate payroll contributes to higher employee satisfaction. Direct deposit and transparent pay stubs make it easier for employees to manage their finances.

- Scalability: As your business grows, your payroll needs become more complex. Payroll tools are scalable, meaning they can grow with your business and handle increasing employee numbers and additional features as needed.

Top 8 Payroll Tools for Small Businesses

For small businesses, choosing the right payroll tool is essential, not just for ensuring timely and accurate payments, but also for managing taxes, benefits, and compliance with various regulations. With numerous options available, finding a tool that fits your business’s specific needs can be daunting.

Also Read: Best HR tools for Small Businesses

| SN: | Tool | For | Starting Price | Free Plan |

|---|---|---|---|---|

| 1 | Gusto | payroll processing with HR management | $ 39/Month | ✅ |

| 2 | QuickBooks Payroll | Payroll and accounting solution | $ 45/Month | ✅ |

| 3 | OnPay | Simplicity and Transparency | $ 40/Month | ❌ |

| 4 | Paychex | flexibility and comprehensive range | $ 39/Month | ❌ |

| 5 | ADP | payroll capabilities and advanced reporting | customized | ❌ |

| 6 | Patriot Payroll | simplicity and affordability | $ 17/Month | ❌ |

| 7 | Wave Payroll | seamless integration with Wave’s other financial | $ 20/Month | ❌ |

| 8 | Square Payroll | sales and payroll | $ 35/Month | ❌ |

We’ve rounded up the top 8 payroll tools for small businesses in 2024. Each of these tools has been selected based on its features, ease of use, customer support, and pricing. Whether you're looking for a solution that integrates seamlessly with your accounting software, offers robust HR features, or provides excellent customer service, you'll find a choice that fits your needs. Let’s dive into each tool and see what makes them stand out in the crowded field of payroll solutions.

1. Gusto

Gusto is a leading payroll tool designed to simplify the complex world of payroll and HR for small businesses. It's well-regarded for its user-friendly interface and robust feature set, making it a popular choice among small business owners who want a comprehensive solution for managing payroll, benefits, and more.

Key Features:

Gusto provides a range of essential payroll functions, including automated payroll runs, tax calculations, and direct deposits. Its employee self-service portal allows workers to access pay stubs, tax forms, and more, all in one place. Additionally, Gusto offers integration with various accounting software and supports benefits administration, making it a one-stop-shop for payroll and HR needs.

Limitations:

Despite its strengths, Gusto does have some limitations. The cost can add up, particularly if you opt for advanced features or have a large number of employees. Some users also find the reporting tools to be more complex than necessary for straightforward payroll needs.

Pros and Cons

Pricing

Gusto’s pricing starts at $39 per month, plus $6 per employee. They offer a 30-day free trial, so you can explore the software before making a long-term commitment. Be aware that costs can increase with additional features and services.

Why It Stands Out

Gusto excels with its all-in-one approach, combining payroll processing with HR management in a user-friendly platform. It’s especially appealing to businesses looking for a seamless, integrated solution.

2. QuickBooks Payroll

QuickBooks Payroll is a powerful payroll tool that integrates seamlessly with QuickBooks Online, a popular accounting software. It’s designed for businesses that are already using QuickBooks and want a payroll solution that works smoothly within that ecosystem.

Key Features:

This tool offers automatic payroll calculations, tax filings, and direct deposit options. It also provides access to a dedicated support team and a mobile app for managing payroll on the go. QuickBooks Payroll is ideal for businesses that need an integrated solution for payroll and accounting tasks.

Limitations:

QuickBooks Payroll’s pricing can be on the higher side, especially for larger teams. The integration benefits are mainly for those already using QuickBooks Online, so it may not be as valuable for businesses using other accounting software.

Pros and Cons

Pricing

QuickBooks Payroll starts at $45 per month plus $6 per employee for the Core plan. There are more advanced options, including the Premium and Elite plans, which offer additional features and support. A 30-day free trial is available for those interested in testing the service.

Why It Stands Out

QuickBooks Payroll is particularly strong for users already within the QuickBooks ecosystem. Its seamless integration with QuickBooks Online and comprehensive payroll features make it a robust option for small businesses needing an integrated payroll and accounting solution.

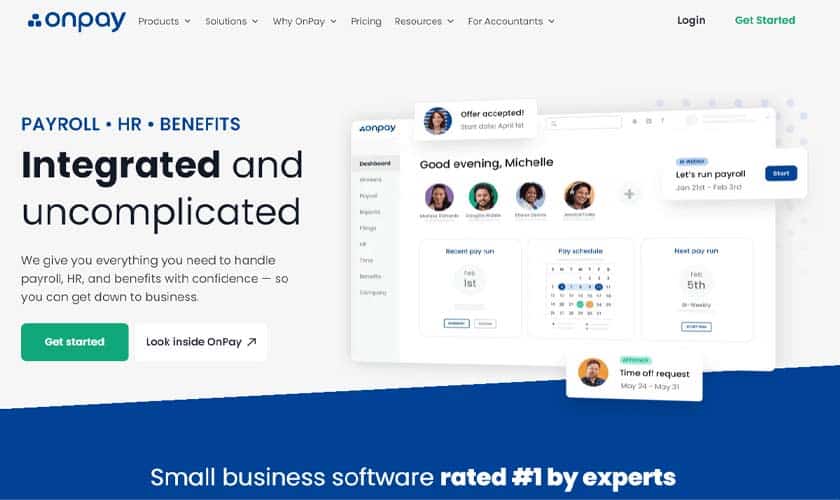

3. OnPay

OnPay offers a streamlined payroll solution designed to simplify complex payroll tasks for small businesses. With its user-friendly interface and comprehensive feature set, it makes managing payroll straightforward and efficient.

Key Features:

- Comprehensive HR Tools: OnPay includes features for calculating paid time off, managing benefits, and handling insurance.

- Easy Setup: The platform is designed to be easy to integrate, with automated tax payments and user-friendly payroll processing.

- Customer Support: Known for its high-quality customer service, OnPay offers support through various channels to help users with any issues.

Limitations:

- No Built-in Time Tracking: OnPay does not include a time-tracking feature, which might be a drawback for businesses needing detailed time management.

- No Automatic Salaried Employee Payments: The platform doesn’t support automatic payments for salaried employees, requiring manual adjustments.

Pros and Cons

Pricing

- Monthly Fee: $40 per month

- Per Employee Cost: $6 per employee per month

- No complex pricing tiers or hidden costs

Why It Stands Out

OnPay stands out for its simplicity and transparency. The clear, straightforward pricing model and effective customer support make it an excellent choice for small businesses that want reliable payroll processing without hidden fees or complex features.

4. Paychex

Paychex is a versatile payroll solution offering extensive customization options. It caters to small businesses that need a tailored payroll system with additional HR and compliance features.

Key Features:

- Customization: Businesses can select from a range of add-on features, including mobile apps, HR support, and detailed reporting.

- Direct Deposit: Paychex supports direct deposit, streamlining payroll payments for employees.

- Compliance Experts: Provides access to experts to ensure compliance with various tax and labor laws.

Limitations:

- Additional Costs: Some features, such as tax administration and W-2/1099 forms, come with extra costs.

- Customer Service: There have been reports of the need for improved customer service.

Pros and Cons

Pricing

- Essentials Plan: $39 per month plus $5 per employee

- Custom Plans: Pricing for more customized options is available upon request

Why It Stands Out

Paychex is notable for its flexibility and comprehensive range of features. The ability to customize your payroll system to fit specific business needs, combined with strong compliance support, makes it a valuable tool for growing businesses.

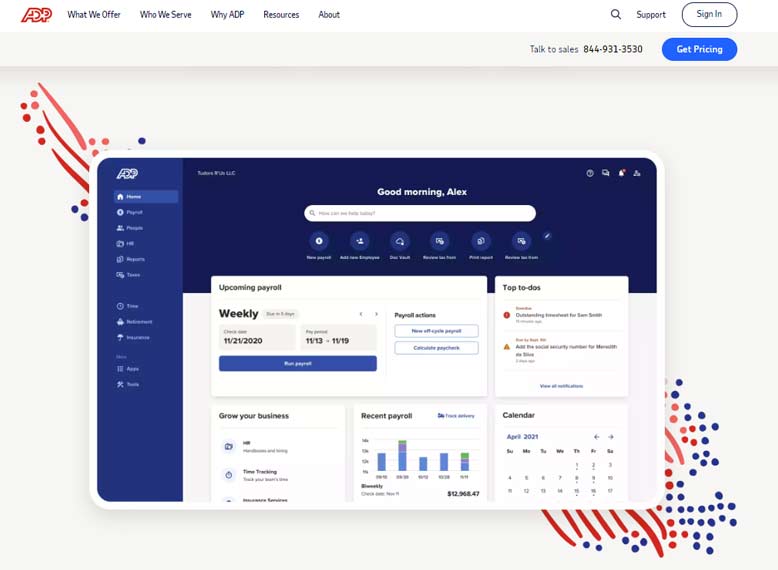

5. ADP

ADP is a heavyweight in the payroll world, known for its comprehensive solutions that cater to businesses of all sizes. It provides a robust system for handling payroll, compliance, and employee benefits with a global reach.

Key Features:

- Global Payroll: ADP supports international payroll processing, making it a great choice for businesses with a global presence.

- Advanced Reporting: Offers in-depth reporting tools that help track and analyze payroll data effectively.

- Integration Capabilities: Easily integrates with various other business systems like accounting software and HR platforms.

Limitations:

- Complex Pricing: ADP’s pricing structure can be complex and varies based on the size of the business and the features chosen.

- Learning Curve: The comprehensive nature of ADP’s platform might require a steep learning curve for new users.

Pros and Cons

Pricing

- Custom Pricing: ADP does not offer a standard pricing model. Costs are based on the specific needs of the business and can be customized.

- Additional Costs: Fees may apply for additional features and services.

Why It Stands Out

ADP stands out for its comprehensive and scalable solutions. Its global payroll capabilities and advanced reporting features make it ideal for businesses looking for a robust system that can handle complex payroll and compliance needs.

6. Patriot Payroll

Patriot Payroll is tailored for small businesses looking for a straightforward, cost-effective payroll solution. It focuses on delivering essential payroll features without the added complexity of more expensive systems.

Key Features:

- Simple Payroll Processing: Offers an easy-to-use interface for processing payroll with minimal hassle.

- Tax Filing: Includes automated tax filing and payment services, helping businesses stay compliant.

- Affordable Pricing: Known for its budget-friendly pricing, making it accessible for small businesses.

Limitations:

- Limited Features: Compared to more comprehensive systems, Patriot Payroll lacks advanced features like extensive reporting or HR management tools.

- Customer Support: The level of customer support may not be as extensive as some higher-end solutions.

Pros and Cons

Pricing

- Basic Plan: $17 per month plus $4 per employee

- Full-Service Plan: $37 per month plus $4 per employee, including additional features like tax filing and compliance assistance

Why It Stands Out

Patriot Payroll stands out for its simplicity and affordability. It’s an excellent choice for small businesses that need a reliable payroll system without breaking the bank. Its focus on core payroll functions ensures that businesses can manage payroll efficiently without unnecessary complexity.

7. Wave Payroll

Wave Payroll is designed with small business owners in mind who want an easy, affordable way to handle payroll. It’s part of the Wave suite, which includes accounting and invoicing tools, making it a convenient choice if you’re already using Wave for other business functions.

Key Features:

- Integrated Solution: Seamlessly integrates with Wave’s free accounting and invoicing software.

- Direct Deposit: Offers direct deposit for employees, streamlining payroll.

- Automatic Tax Calculations: Calculates and withholds taxes automatically, reducing the risk of errors.

Limitations:

- Limited to US and Canada: Currently only available for businesses in the United States and Canada.

- Basic Features: Lacks some advanced features found in more expensive payroll systems, such as extensive reporting or HR tools.

Pros and Cons

Pricing

- Base Plan: $20 per month plus $6 per employee

- Additional Costs: No hidden fees, but additional features or services may incur extra charges.

Why It Stands Out

Wave Payroll stands out for its seamless integration with Wave’s other financial tools and its straightforward pricing. It’s particularly advantageous for small businesses already using Wave’s accounting software, offering a unified platform for managing finances and payroll.

8. Square Payroll

Square Payroll is part of the Square ecosystem, known for its point-of-sale and business management tools. It offers an easy-to-use payroll solution that works well for small businesses and integrates seamlessly with other Square products.

Key Features:

- Simple Integration: Works effortlessly with Square’s POS system and other business tools.

- Automatic Tax Filing: Handles tax calculations and filings, ensuring compliance.

- Employee Benefits: Offers options for employee benefits like health insurance and retirement plans.

Limitations:

- Basic Reporting: Reporting options are more limited compared to some other payroll systems.

- Limited Features: While it’s user-friendly, it may lack some advanced features that larger businesses might need.

Pros and Cons

Pricing

- Base Plan: $35 per month plus $5 per employee

- Additional Costs: Includes basic features, with potential additional costs for more advanced services.

Why It Stands Out

Square Payroll stands out for its ease of use and integration with Square’s suite of business tools. It’s a solid choice for small businesses that already use Square for point-of-sale and other functions, offering a cohesive solution for managing both sales and payroll.

How to Choose the Right Payroll Tool for Your Business

Choosing the right payroll tool for your small business isn’t just about finding the flashiest software. It’s about matching your specific needs with the features that will streamline your operations and make your life easier. Here’s how to cut through the noise and find a payroll tool that fits like a glove.

Key Features to Consider

When selecting a payroll tool, you’ll want to keep a close eye on a few critical features.

- Ease of Use: Look for a platform that’s intuitive and user-friendly. A tool that's complicated or has a steep learning curve can become a source of frustration rather than a help.

- Automated Tax Calculations: Ensure the tool can handle tax calculations and withholdings automatically. This feature saves time and reduces the risk of errors that could lead to costly penalties.

- Direct Deposit Capabilities: Direct deposit is a must for modern payroll. It speeds up payment and improves employee satisfaction.

- Compliance Tools: Your payroll tool should help ensure compliance with local, state, and federal regulations, including tax laws and labor standards.

- Integration with Other Systems: If you use other business software (like accounting or HR systems), check that the payroll tool integrates seamlessly with these tools to avoid manual data entry.

- Customer Support: Reliable customer support can be a lifesaver, especially if you run into issues or need assistance with complex payroll tasks.

Comparing Costs and Pricing Models

Understanding the pricing structures of payroll tools can help you avoid unexpected costs and find the best value for your money.

- Base Price vs. Per-Employee Fees: Some tools charge a base fee plus a per-employee fee, while others might have a flat rate regardless of the number of employees. Determine which model aligns better with your budget and business size.

- Additional Costs: Be aware of any extra charges for services like tax filing, direct deposit, or advanced features. These can add up, so factor them into your total cost comparison.

- Free Trials and Demos: Many payroll tools offer free trials or demos. Take advantage of these to test the software and ensure it meets your needs before committing to a subscription.

- Long-Term Value: Consider not just the initial cost but the long-term value of the tool. A slightly higher upfront cost might be worth it if the tool offers greater efficiency and fewer headaches in the long run.

Finding the right payroll tool involves a balance of features, cost, and fit for your business’s unique needs. By focusing on these key aspects, you’ll be well on your way to choosing a tool that makes managing payroll a breeze.

Benefits of Using Payroll Tools for Small Businesses

When it comes to managing payroll, the right tools can make a world of difference. For small businesses, investing in a payroll solution isn’t just about keeping things organized—it’s about reaping significant benefits that enhance overall operations and employee satisfaction. Here’s how these tools can turn payroll headaches into smooth sailing.

Time-Saving and Efficiency

Running a small business often means juggling multiple roles, and payroll can be one of the most time-consuming tasks. Payroll tools streamline this process, automating many of the routine functions like calculating hours, deductions, and taxes. This automation not only reduces the time spent on payroll tasks but also frees up valuable hours that can be better spent on growing your business or serving your customers.

With automated payroll tools, you can also set up recurring tasks, such as direct deposits and tax filings, which means fewer manual inputs and less chance for errors. Imagine having the time you’d spend on manual payroll tasks back in your day—what could you do with that extra time?

Accuracy and Compliance

Payroll isn’t just about cutting checks; it’s about ensuring that those checks are accurate and compliant with ever-changing tax laws and regulations. Mistakes in payroll can lead to compliance issues, fines, and unhappy employees. Payroll tools help mitigate these risks by performing complex calculations automatically and keeping up-to-date with current tax rates and laws.

These tools often come with built-in compliance features that alert you to potential issues before they become problems. They can generate reports and filings that are accurate and timely, reducing the risk of errors and ensuring that your business stays on the right side of the law.

Employee Satisfaction

At the end of the day, happy employees are productive employees. Payroll tools can significantly enhance employee satisfaction by ensuring that paychecks are delivered on time and are accurate. Direct deposit and electronic payslips add a layer of convenience that employees appreciate. No more waiting for checks to clear or dealing with lost paperwork.

Moreover, many payroll tools offer features that allow employees to access their pay stubs, view their earning history, and manage their own personal details. This transparency can help build trust and reduce the number of payroll-related inquiries, leaving your employees happier and more engaged.

Trends in Payroll Tools for Small Businesses in 2024

As we move through 2024, the landscape of payroll tools is evolving rapidly. Small businesses are seeing more advanced features and innovative technologies that make managing payroll easier and more efficient than ever. Here’s a look at some key trends shaping the payroll industry this year.

Automation and AI Integration

Automation has been a game-changer in payroll management, and its role is expanding thanks to artificial intelligence (AI). Today’s payroll tools are increasingly leveraging AI to handle repetitive tasks with greater accuracy and speed. AI-powered systems can automate complex calculations, predict payroll issues before they arise, and even provide actionable insights based on data trends.

For instance, AI can help identify discrepancies or anomalies in payroll data that might be missed by human eyes. This means fewer errors and less manual checking. Automated reminders and updates ensure that everything is processed on time, reducing the risk of late payments and compliance issues. With these advancements, payroll processing becomes less of a chore and more of a seamless part of your business operations.

Cloud-Based Solutions

Cloud technology is transforming how businesses manage their payroll. Cloud-based payroll solutions offer unparalleled flexibility and accessibility. Because the software is hosted on remote servers, you can access your payroll system from anywhere with an internet connection. This is particularly useful for businesses with remote employees or multiple locations.

Cloud-based systems also ensure that your data is backed up and secure, minimizing the risk of data loss. Regular updates and improvements are rolled out seamlessly, keeping your system current with the latest features and compliance regulations. This means you’re always working with the most up-to-date tools without needing to handle manual upgrades or installations.

Mobile Accessibility

In today’s fast-paced world, mobile accessibility is more important than ever. Payroll tools are increasingly offering mobile-friendly options, allowing both employers and employees to manage payroll tasks on the go. Mobile apps and responsive designs make it easier to handle payroll from a smartphone or tablet, which is a huge advantage for busy small business owners.

Employees can check their pay stubs, update personal information, and even submit time-off requests right from their mobile devices. For employers, mobile access means you can approve payroll, view reports, and handle urgent issues no matter where you are. This level of convenience helps streamline payroll management and keeps everything running smoothly even when you’re not at your desk.

In summary, the trends in payroll tools for 2024 are all about embracing advanced technology to make payroll management more efficient, flexible, and accessible. From AI and automation to cloud-based solutions and mobile apps, these innovations are helping small businesses stay ahead of the curve and focus on what they do best.

Conclusion

From the user-friendly interfaces of Gusto and QuickBooks Payroll to the comprehensive solutions of ADP and Paychex, each tool offers its own set of strengths. Tools like OnPay and Wave Payroll stand out for their cost-effectiveness, while Square Payroll and Patriot Payroll cater to specific business needs with their unique features.

When choosing the best payroll tool for your business, consider the key features that matter most to you—whether it's automation, mobile accessibility, or cloud-based solutions. Evaluating the costs and pricing models will help ensure you find a tool that fits your budget while delivering the functionality you need.

In the end, the right payroll tool can transform payroll from a tedious task into a streamlined process, allowing you to focus more on growing your business and less on administrative details. By choosing wisely and leveraging these advanced solutions, you can ensure that your payroll management is efficient, accurate, and aligned with your business goals.